🏎️Concentrated Liquidity

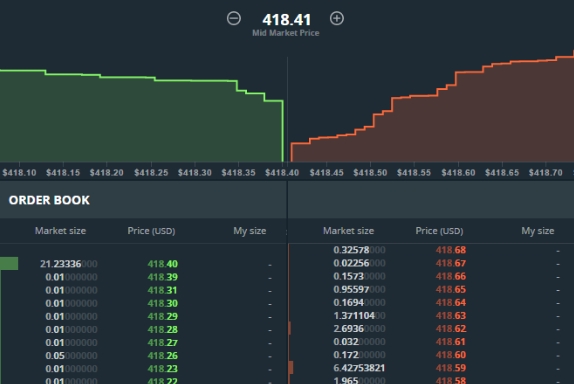

Concentrated Liquidity is, currently, the most efficient and profitable method of market making that on-chain decentralized exchanges have access to. This was popularized and took the space by storm when Uniswap released their UniV3 model. To get an idea of what UniV3 offers we can compare it to a more centralized, and well-known, liquidity scheme: A CEX Order Book.

As you can easily see in the CEX Order Book diagram above, the bid (buys) and asks(sells) are clearly shown, and the depth at which a market order would impact the median price is visually discernible. Interesting enough, the concentrated liquidity model, is represented visually as an inverse histogram of the order book. (Flip the photo upside down and invert the colors).

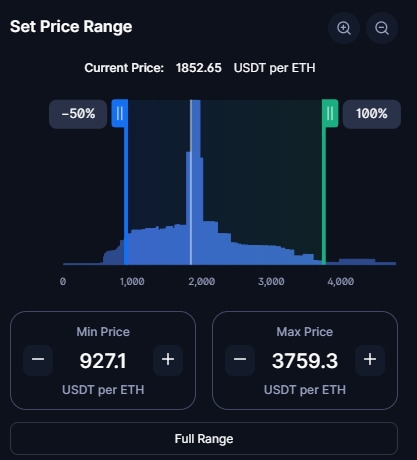

The blue area shaded in represents the liquidity ranges summated between all users within the LP pool [within the same fee-tier, more on this later].

To make it very clear the efficacy differential between x*y=k (uniV2) and UniV3's orderbook-style AMM-- it needs to be explained that typical LP positions operate on a (0,∞) range.

This means that each individual user in the pool is subject to providing liquidity in every possible positive real-number. Since every trade has to consider this when the swapping algorithms are ran, $100,000 of liquidity spread from 0 to ∞ is exponentially less efficient than, say, one with a defined range of ($1,000-$1,100). With the latter example of the $1,000-$1,100 liquidity range, it is calculatable that the same $100,000 of liquidity is now concentrated in a $100 price range, providing an EXTREMELY efficient swapping experience. Providing the lowest slippage currently feasible within the DeFi space.

Last updated